Learning Objectives

- Understand the concept of limited liability and its connections with psychology, risk diversification and corporate finance

- Describe inflation indexed debt, and monetary innovation designed to tackle hyperinflation

- Understand the basics of the real estate market, assumptions behind forecasting the stock market, and the basic framework to price a stock

- Describe the key intuition and definitions behind the Efficient Market Hypothesis, and why it might only be half-truth

- Describe and provide examples of the wishful thinking bias and cognitive dissonance.

- List key features of Antisocial Personality Disorder and Borderline Personality Disorder

Lesson #5

Video: Invention Takes Time

Ideas that seem simple and natural, somehow don't get established. Here are some examples:

- Wheeled toys discovered in Mexico between 650 and 950 A.D. but no wheeled vehicles found until the post-Columbian era (~1492 A.D.)

- Wheeled suitcases

- Bernard Sadow, 1972 - Invented wheeled suitcases that were pulled with a strap. This wasn't received that well, and had the flaw of falling over

- Robert Plath, 1991 - Invented a rigid handle with only 2 wheels. He was an airline pilot and wanted to easily get through airplane aisles without bumping into anyone. This completely took off

- Movie subtitles were invented in 1920, but were not used in silent movies, they used intertitles instead (showing the subtitles in between clips)

- Desks over exercise bikes - still not mainstream

Question: Is there an ideal for what the future looks like?

According to Dr. Shiller, it's not so simple and obvious to create an ideal, such as the ideals of Karl Marx. The human species is the product of evolution and some of the evolutionary traits that served us well during the caveman era, isn't serving us well today.

Video: Salon - Innovation

Question: What do you think has been important about the innovation of people's abillity to insure against risk in the marketplace?

The history of risk management goes back thousands of years, yet the technology we have has been very slow to develop. This may be because there's an inherent mistrust of new financial arrangements. People don't want to participate unless the "in-people" participate.

Financial innovation is a pillar of our civilization. It's a sequence of inventions that:

- Incentivise people

- Provide capital for enterprises

- Create organizations that last through time that separate themselves from the objectives of the individuals who comprise the corporation

- Get people focused on some common good

Comment: It doesn't seem like Dr. Shiller answers the student's original question. He even mentions this himself.

Question: Do you think it's safe to say that historically, financial innovation has occurred on the upside? Looking to capture new markets and new ways of earning returns, versus on the, kind of the downside risk management side of the ledger?

Risk management seems to imply a focus on the downside, but it's on the upside as well. People accept downside risk because there's something on the plus side that is enticing and exciting. People seem to like to gamble with small amounts of money with a low probability of winning a large reward. For example: paying $2 for a near-zero chance of winning $10 million.

It's not completely known why this behaviour exists but it may be because it gives hope and excitement for the future. Even if you lose, it's only $2 so it doesn't matter. The same can be said for investing in stock. You could make an investment for $3000 for 100 shares. This may be more than a $2 lottery ticket, but it could still reward you with millions, if you picked the right company. This is one benefit that the "Limited Liability Corporation" innovation provided.

People tend to be disappointed almost always because of the low probabilities but they're still not fully disappointed because it leads to a more vital business sector where things are created. This is a part of financial innovation: reframe risk so that it's appealing.

Video: Limited Liability

Limited Liability: An idea that an enterprise can be divided into shares and investors, in order to be encouraged to invest in businesses, should have protection against liability for what the managers of the business do.

Example: If you invest in business which sends a ship out to trade goods, and if the ship sinks, you are not liable for having to pay back the loan on the ship.

At first, investors were only liable for their share in the company. Though rare, investors could still go to "debtors' prison" if the company they invested in participated in criminal activity. This was extra risk that investors had to manage.

When New York State passed the law for Limited Liability, there was a lot of controversy that this would lead to corruption and a transgression of laws. In light of that, Massachusetts passed a law reaffirming that shareholders are responsible for what they invest in. The result was that almost all business went to New York and it became a mecca for business. Eventually the other states followed suit and enacted limited liability laws.

Though there were some massive failures due to corruption but there were many amazing successes too.

It seems that if you are responsible for everything you get involved in, you won't do it! With limited liability, you know that the worst that can happen is that you lose what you put in. You won't lose more than that.

David Moss - Why Limited Liability Corporations Were Successful

- Investors overestimate the minuscule probability of loss beyond the initial investment (weighting function)

- Lottery effect: with limited liability, an investment in a corporation was a throwaway item

- Allowed for investors to hold a highly diversified portfolio

Video: Inflation Indexed Debt

Traditionally, money was borrowed with debt contracts that had a promise to pay back in a currency. If that currency was debased then inflation would erode the value of the debt.

A price index, such as the Consumer Price Index (CPI), is a value based on the price of a basket of items.

Inflation Indexed Debt is a security which is tied to an index.

The first instance of Inflation Indexed Debt was in the United States in 1780 when the US Government was giving debt to soldiers to fight in the Revolutionary War in currency that was issued by the state governments. Because of the war, they began to debase the currency, causing rapid inflation. This demotivated the soldiers as their reward was worthless before they even claimed their debts.

Video: Unidad de Fomento

Due to hyperinflation in Chile in 1967 (~1,000% a year), a new unit of account was invented, Unidad de Fomento, which means unit of development.

Money has several functions

- Store of value

- Unit of account

- Means of transactions

You can have a separate unit of account that is not money. Chile created the UF which was tied to the CPI.

The US is not a haven from inflation either. Since 1913, prices have gone up over 24 times.

Video: Real Estate: Risk Management Devices

We don't have any protection for the changes in the value of your house. Perhaps being able to short the housing market will help protect you from this. Currently, if you take a loan out for a house and the value decreases than what you paid, it's your loss and the bank won't do anything to help.

Question: You talk a lot about financial innovations, is there anything of recent that is really exciting for you that is the next frontier of finance?

An example of an innovation to protect against the value of your home dropping in value is being able to buy a put option on your house on the Chicago Mercantile Exchange. Another example would be to protect your wage in case you lose your job and take another job with a lower wage.

Lesson #6

Video: Forecasting

Efficient Markets Hypothesis

The efficient-market hypothesis (EMH) states that asset prices reflect all available information at any point in time. This means that it is impossible to consistently choose stocks that will beat the returns of the overall market.

Experiment in Forecasting

Students were asked to forecast the S&P 500. The results indicated that students were drawing plausible outcomes, not expected outcomes. This was due to our tendency to use the representativeness heursitic - a mental shortcut used when making judgments about the probability of an event under uncertainty. In this case, students were showing that what they saw in the past was representative of what will happen in the future.

The Random Walk Theory

Proposed by Karl Pearson in 1905A random walk is a process that changes in such a way that each change is independent of previous changes and totally unforecastable. Modeled as: xt=xt-1+εt

First-Order Autoregressive (AR-1) Model

Alternative to the Random Walk Model but has a tendency to revert back to historical values.

Video: Intuition of Efficiency

It's easy to reason that all factors are priced into the current value of an asset in a market. This is what is meant by efficiency.

3 Forms of Efficiency

- Weak form: prices incorporate information about past prices

- Semi-strong form: incorporate all publicly available information

- Strong form: incorporate all information, including inside information

Video: Price as Present Discounted Value (PDV)

Gordon Model

P=E/(r-g) where E is earnings, r is the discount rate and g is growth rate

Reasons to Think Markets Ought to Be Efficient

- Marginal investor determines prices

- Smart money dominates trading

- Survival of the fittest

Video: Doubting Efficiency

A study was done that showed that higher SAT scores lead to higher performance.

A lot of the smartness is gone into marketing and manipulation of your psychology.

Question: After the efficient markets hypothesis, do yu think that large stock market crashes like that in 1987 or in 2008, disprove or prove the efficient markets hypothesis?

There isn't enough data to prove or disprove the hypothesis, you need more than 2 events. Being actively involved in the market during these times showed participants that emotions are definitely involved.

Lesson #7

Video: Introduction to Behavioural Finance

Adam Smith, wrote The Wealth of Nations and mentioned the idea that the market is an "invisible hand" which directs the economy. He also noted that people like to be praised and as one get's older that desire turns into a desire to be praiseworthy. This is different than the idea that one wants to maximize consumption.

Video: Prospect Theory

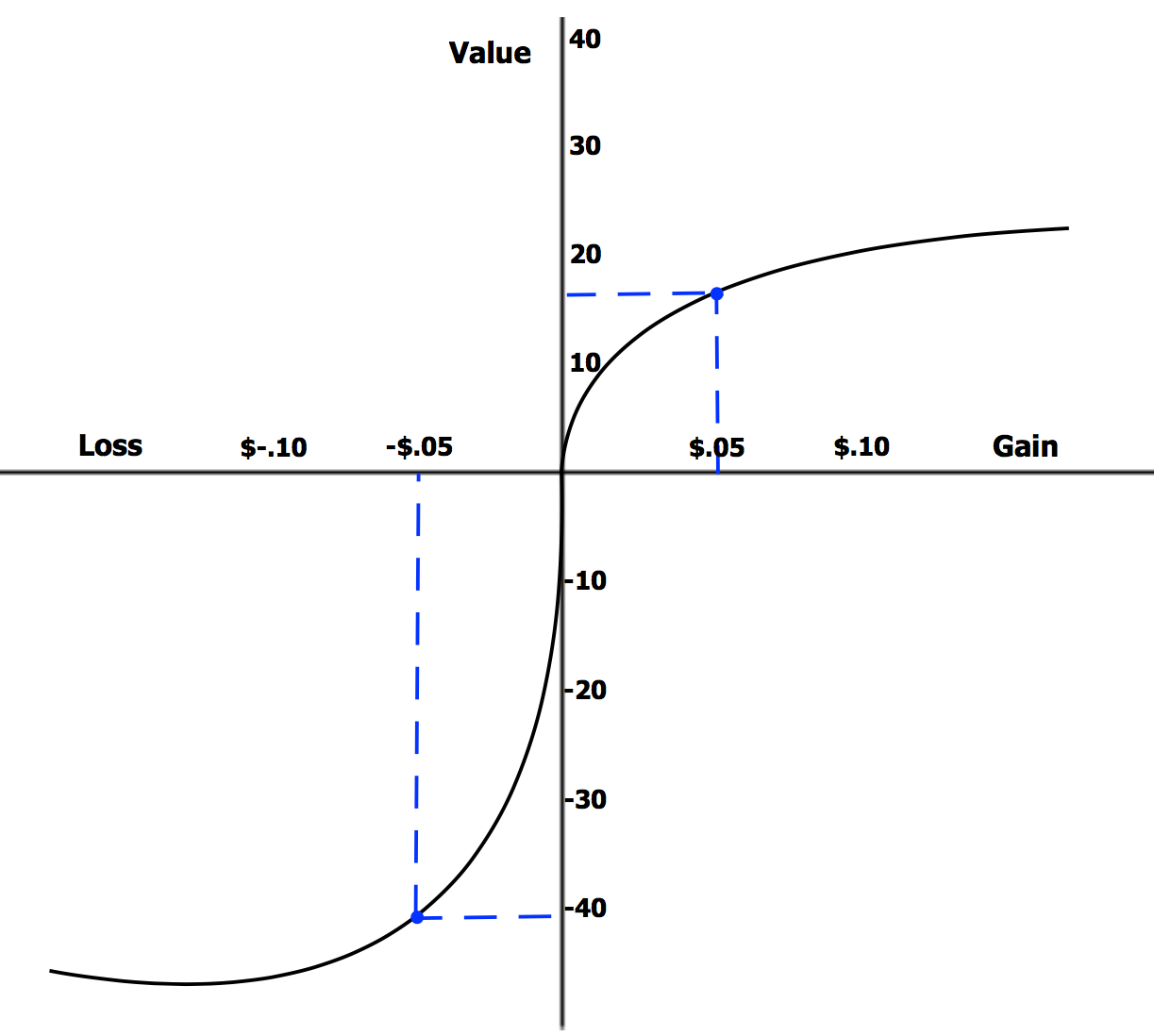

Daniel Kahneman and Amos Tversky wrote a paper in Econometrica, 1979 where they criticized the core theory of economics. They proposed 2 changes. One, replacing the Utility Function with the Value Function. Two, replacing probabilities with subjective probabilities determined by a weighting function in terms of the actual probabilities.

Value Function

This graph demonstrates that we're subjective and we think relative to where we are now (the origin). One implication is that we undervalue small gains and overvalue small losses.

Weighting Function

The dotted line represents objective probabilities. The solid line represents decision weights by individuals. This demonstrates that for very low probabilities, we don't appreciate them and for very high probabilities we assume they will be 100%.

Video: Chalk Talk - More on Prospect Theory

The theory is mainly overturning the economists' idea that humans are calculating, rational maximizers. According to Kahneman and Tversky, this isn't the case. People act according to a value function, that isn't completely rational. Consider the example of a bet on a fair coin toss. If it lands tails, you lose $100. If it lands heads, you win $200. Rationally, this is a bet worth taking, as it's worth $50 in your favour ($200 * .5 - $100 * .5). Most people will not take this bet, because the loss of $100 is perceived to be greater than the gain of $200.

Video: Logical Fallacies

Overconfidence

Most people think they're above average. Most people think that their team will win. People are also overconfident in their friends and leaders.

Cognitive Dissonance

Mental conflict that occurs when there are inconsistencies between your thoughts and beliefs when compared to your actions or new information that contradicts your beliefs.

Disposition effect - tendency of investors to hold on to decreasing assets and sell increasing assets

Video: The Brain

Mental Compartments

Investors have 2 portfolios: a "safe" and a "risky" portfolio.

Attention Anomalies

We can't pay attention to everything. We have a social bias for attention.

Anchoring

A tendency for our decisions to be affected by some anchor.

Representativeness Heuristic

A mental shortcut where people judge by similarity to familiar types.

Disjunction Effect

The inability to make a decision that relies on future information.

Video: Magical Thinking

The belief that one's thoughts and actions can influence the events of the physical world.

Quasi-Magical Thinking

The belief that one's actions can influence the outcome. For example, people think that deciding heads or tails of a coin before it's thrown will have an effect on the outcome. They don't think this is the case if they make the decision after it's already thrown.

Video Personality Disorders

Culture and Social Contagion

Our thoughts and actions are influenced by our culture and society.

Antisocial Personality Disorder (Sociopathy)

Sociopaths are egocentric, self-directed, have a lack of empathy, are manipulative and irresponsible.

Borderline Personality Disorder

Characterized by instability of interpersonal relationships, extremes of over-idealization and then devaluation of others, depressed moods, inappropriate intense anger and frantic efforts to avoid real or imagined abandonment.